As the deadline for Salford’s new Article 4 Direction approaches, investors planning to convert a property to an HMO (House in Multiple Occupation) in Salford (Swinton, Worsley, Walkden, and Little Hulton) need to be fully prepared. Ensuring your development complies with the new regulations before the 17 November 2024 deadline is crucial to avoid future planning permission issues.

Understanding the New Article 4 Direction

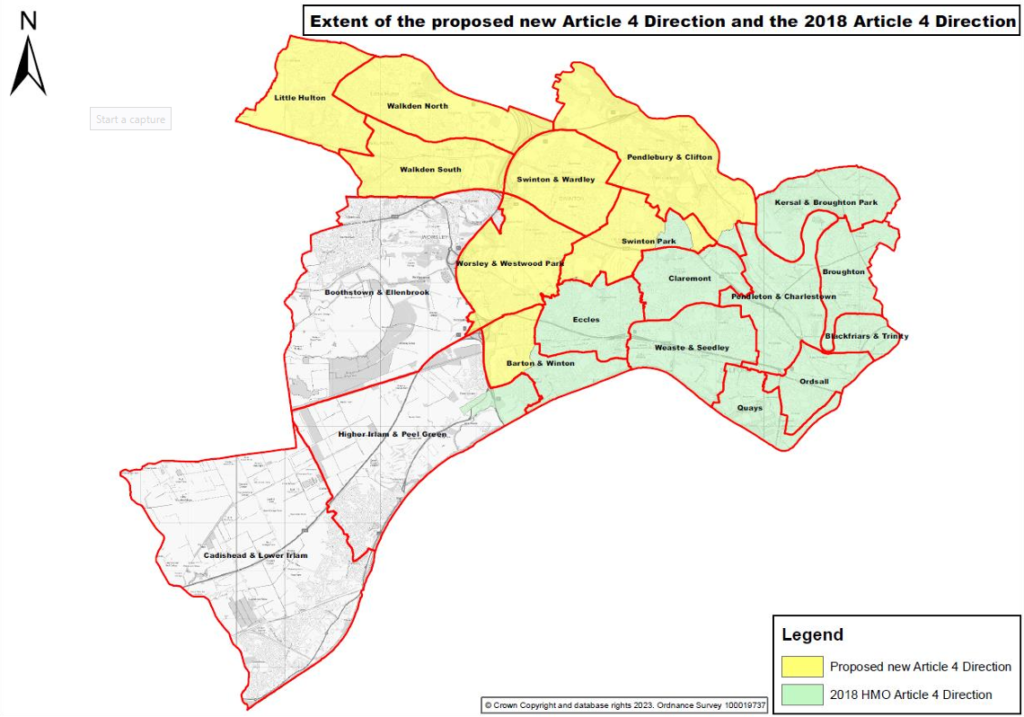

Salford City Council first implemented an Article 4 Direction in November 2018, requiring planning permission for converting dwellinghouses into small HMOs in specific areas. This policy initially covered all Central Salford wards and parts of Barton and Eccles. However, an additional Article 4 Direction, confirmed on 9 July 2024, extends these requirements to new areas, effective from 17 November 2024.

Key Areas Affected by the 2024 Article 4 Direction

The new Article 4 Direction will encompass:

- Little Hulton

- Swinton and Wardley

- Walkden North and Walkden South

- Worsley and Westwood Park

- Parts of Barton and Winton, Pendlebury and Clifton, and Swinton Park not covered by the 2018 direction.

From 17 November 2024, the only areas in Salford exempt from requiring planning permission for converting a dwellinghouse into a small HMO will be Boothstown and Ellenbrook, Cadishead and Lower Irlam, and Higher Irlam and Peel Green.

Proving Your Development Commenced Before 17 November

Investors must provide evidence that their development began before 17 November to avoid needing planning permission under the new Article 4 Direction. The planning department has outlined several acceptable forms of evidence to demonstrate this:

Types of Acceptable Evidence for your HMO in Salford

- Dated Photos: Photographic evidence showing the progress of works can be compelling. Ensure these photos are clearly dated and show significant milestones in the conversion process.

- Bills and Invoices: Keep records of any payments made to contractors or for materials. These should be dated and itemized, showing the nature of the work carried out.

- Written Log: Maintain a brief written log detailing key milestones in the development. This log should include dates and descriptions of the work completed.

- Other Documentation: Any other relevant documentation, such as delivery receipts for materials, can also support your claim that the development commenced before the deadline.

- Building Control Notices: Submitting building control notices before the deadline can also serve as evidence. These notices show that you have engaged with the council regarding compliance with building regulations, indicating that work has started.

The evidence needs to be proportionate to satisfy the council that works had started before 17 November if someone complains to say works did not start before this date.

Why This Matters for Investors

The Article 4 Direction is part of Salford City Council’s broader effort to manage the proliferation of small HMOs, ensuring they meet community standards and do not negatively impact local areas. By requiring planning permission, the council can better regulate the quality and suitability of these conversions, protecting both tenants and neighbours.

For investors in Swinton, Worsley, Walkden, and Little Hulton, understanding these regulations is crucial. Ensuring compliance can save time, money, and potential legal complications down the line.

FAQs from Investors

What if I’m partway through a conversion on 17 November?

Government guidance indicates that if you have started the conversion before 17 November but have not completed it, you can continue without needing to apply for planning permission. This exemption applies as long as you can provide the necessary evidence of commencement.

What areas remain unaffected to convert an HMO in Salford?

From 17 November 2024, the only parts of Salford where planning permission will not be required for the change of use of a dwellinghouse to a small HMO are the wards of Boothstown and Ellenbrook, Cadishead and Lower Irlam, and Higher Irlam and Peel Green.

How can I ensure compliance?

To ensure compliance, gather and organize your evidence now. Take dated photos, keep a detailed log, and save all bills and invoices related to the conversion. If you need further guidance, contact the Spatial Planning team at Salford City Council.

Making the Most of Your HMO in Salford

Investors looking to convert properties into HMOs in Swinton, Worsley, Walkden, and Little Hulton must act swiftly. With the 17 November deadline looming, ensuring your developments comply with the new Article 4 Direction will be essential for protecting your investment and avoiding unnecessary delays.

Given that purchasing a property with a mortgage typically takes 3 to 6 months, it is advisable to start the purchase process now to allow sufficient time to begin conversion works before the deadline. Investors may need to expedite the sale process by choosing a responsive conveyancer, preparing all necessary documentation in advance, and even considering a cash purchase to avoid delays.

Obtaining a Key Undertaking

If the purchase isn’t completed but you need to start works, obtaining a key undertaking can be a solution. This legal agreement allows you to start work on the property before completion, with strict conditions to ensure the seller’s interests are protected. This typically involves agreeing not to occupy the property, assuming full responsibility for any damages, and having insurance in place. This can be part of a purchase option agreement, which allows you to secure the property for purchase at a later date, often after completing initial works.

Conclusion for your HMO in Salford

With the deadline fast approaching, it’s vital for investors to act now to ensure their HMO in Salford development meets the requirements of Salford’s Article 4 Direction. By understanding the new regulations and preparing the necessary evidence, you can avoid the need for retrospective planning permission and ensure your properties remain compliant.

For more details on the Article 4 Direction, visit Salford City Council’s website. If you have any questions, reach out to the Spatial Planning team via email: plans.consultation@salford.gov.uk or get in touch with us at Confidence Property.